A well-designed COA helps you understand what’s actually happening in your business.

What Is a Chart of Accounts, Anyway?

Think of it as a financial filing cabinet. It’s a structured list of all the categories your business uses to track money coming in and going out: revenue, expenses, assets, liabilities, equity—the works. Every transaction gets filed under one of these accounts.

But here’s the thing: not all filing systems are created equal.

Why a Well-Designed Chart of Accounts Matters

1. It Gives You Clean, Actionable Data

A good COA organizes your finances in a way that makes sense for your business. It separates what you need to know from what’s just noise. Want to see how much you’re spending on software subscriptions? Or track how profitable your different services are? That’s only possible if your COA was set up with intention.

2. It Makes Tax Time (Slightly) Less Awful

When your income and expenses are clearly categorized, your accountant isn’t left playing detective every March. Fewer questions. Fewer errors. Less stress. (And possibly lower fees, because guess what—your CPA charges more when they have to untangle spaghetti.)

3. It Helps You Make Smarter Decisions

Want to cut costs? Grow a specific part of your business? Apply for a loan? You need accurate financial reports to do that. Those reports are only as good as the categories feeding them.

4. It Scales With You

If your COA is designed with your future in mind, it can grow as your business grows—without needing a total overhaul every time you add a new product, service, or location.

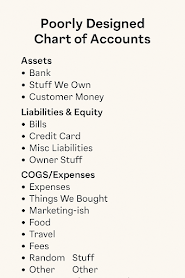

What Happens When Your Chart of Accounts Is a Hot Mess?

Let’s be honest—most small business COAs start out as a mess. Either someone winged it in QuickBooks, or it was copied from another business that has totally different needs. Here’s what happens when it goes off the rails:

❌ You can’t tell where your money’s going. Everything’s lumped under vague categories like “Miscellaneous” or “General Expense,” which tells you… absolutely nothing.

❌ You waste time and energy. If you (or your bookkeeper) have to constantly guess where to put a transaction, you’re burning time and setting yourself up for inconsistent reports.

❌ You make bad decisions. If your data is fuzzy, your choices will be too. You might overinvest in something that looks profitable—but isn’t. Or underfund a part of your business that’s quietly carrying the team.

❌ You confuse the heck out of your accountant. No one wants to be on the receiving end of a passive-aggressive email titled “Re: Re: Clarification on that ‘Fun Stuff’ expense account?”

So What Should You Do?

✔️ Start with a custom-tailored chart of accounts that fits your business type, size, and goals—not a generic template.✔️ Keep it lean, but detailed where it counts. Don’t go overboard with 200 accounts you’ll never use. Focus on categories that help you make decisions.

✔️ Review it regularly. Your business isn’t static—your COA shouldn’t be either. Make updates as your operations evolve.

✔️ Work with a pro. (Yes, this is where we plug ourselves.) A professional bookkeeper can help design or clean up your chart of accounts so you’re not flying blind.

Bottom Line

Your chart of accounts isn’t just some back-office bookkeeping task—it’s your business’s financial GPS. When it’s designed right, everything else runs smoother: reports, taxes, strategy, growth. When it’s not, you’re basically guessing.

Don’t guess. Get clarity.

Need help cleaning up your chart of accounts or starting from scratch?

We’d be happy to take a look—and save you from another year of wondering what “Other Stuff” really means. Schedule a consultation with us today at https://www.plsbalancemybooks.com/#consultationTurn your

.jpg)